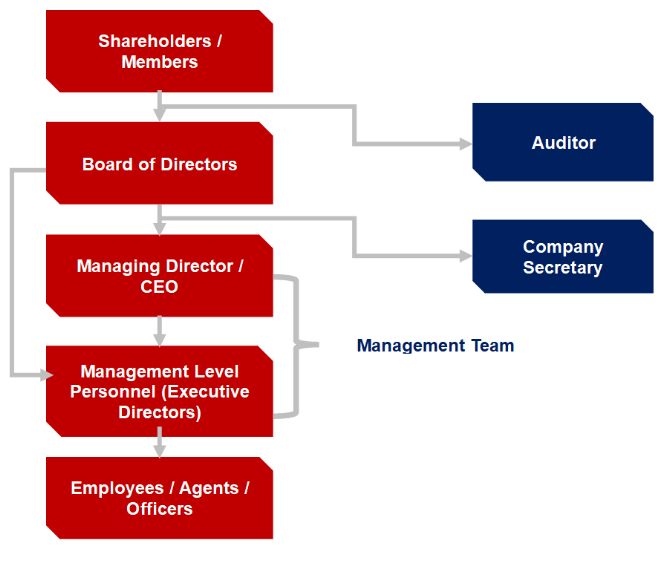

Every company, including statutory corporations, must have a board of directors, which is the directors acting together. Directors are supposed to be the brain and mind of the company.

The directors are to direct the affairs or business of the company. Performing the function of directing the business of the company requires as a minimum that the persons have the required capacity to direct the particular business the company is engaged in. In other words, a basic requirement to ensure the business of the company is properly directed is to have a sufficient number of directors with the requisite knowledge and experience to direct the business of the company. In order to ensure that is done, a company must set the right qualification criteria, go through the right appointment process and clearly define the scope of the responsibilities, duties and obligations of the directors (which the directors must be oriented on).

Are your directors really qualified?

Usually, the decision to set up a company to carry out a business or pursue an object is taken by one businessman or business partners who have come up with a business plan. In making enquiries for incorporation, he is told that he needs at least two persons as directors for the incorporation. Invariably, the decision taken by this businessman is based on who is likely to agree with him or related to him, or who he can control. A husband or wife is likely to choose a spouse. Others are likely to select a relative or a friend. Others may appoint based on the name of a person or religious, ethnic or political affiliations with the hope of leveraging on such factors for business. In the case of business partners, they may choose to be the directors.

The point is, very often, the decision on who to appoint is not based on clearly defined qualification criteria set out anywhere which could serve as a guide. Therefore, in many instances there are round pegs in square holes. That is, the wrong persons are appointed to the boards of companies. This, in most instances, has led to unqualified persons directing the business of a company. Consequently, companies have underperformance and in some cases collapsed.

What then are the qualification criteria for the appointment of directors? There are no one-size fits all criteria. The law recognizes this and hence did not set out positive qualification criteria in terms of the knowledge and expertise a person must have to be appointed a director of a company under the Companies Act, 2019. The law only stated a few persons who are disqualified from being appointed as directors of a company. These are:

- an infant;

- a person adjudged to be of unsound mind;

- a body corporate;

- a person prohibited by order pursuant to stated offenses; and

- an undischarged bankrupt.

Once a person does not fall under any of the disqualifications above, the person can be appointed a director. However, not everyone outside the list of disqualified grounds should clearly be a director. Should a director not be able to read and understand? Should a director not have any experience in relation to the business or not have any formal education? These positive qualification criteria are not provided by law. However, the law makes room for persons setting up a company to so provide specific criteria in the constitution of the company. Each company must, therefore, ensure that there are clear qualification criteria set out in the constitution so as to prevent unqualified persons from being appointed directors. What are the criteria stated your constitution?

There have been positive qualification criteria prescribed by sector regulators for specific sectors. For example, the Bank of Ghana as regulator of banks and specialised deposit-taking institutions has prescribed educational qualifications and experience level requirements for directors of banks and specialised deposit taking institutions per its two directives – The Banking Business-Corporate Governance Directive, 2018 and The Fit & Proper Person Directive, 2019. A director must, therefore, be approved as fit and proper by Bank of Ghana before he becomes a director of a bank or specialised deposit-taking company.

Other sectors have similar prescription including listed public companies and companies operating in the insurance and pension sectors. The question that should occupy the mind of the Registrar of Companies, as the general regulator of companies, is whether the time is ripe to have an overarching prescription for all companies. Meanwhile, in the absence of a general prescription, the constitution of each company must provide for the qualification criteria.

It is a generally accepted corporate governance position that expertise in the industry in which the company operates, expertise in finance since every company requires finance, and expertise in applicable law must be manifest on the board. With current leaps in the technology space, that has also been touted as expertise that must be considered. Therefore, the board must have persons with background in the industry, finance and law. This does not necessarily mean a company must have directors with this expertise. A company may depend on advisors for these expertise. However, the directors must in their own right be able to understand the interplay of these areas of expertise in taking strategic decisions for the company.

The failure to provide criteria for selecting directors will likely harm the company. It is the hallmark and starting point of good corporate governance. Attracting investors and securing credit depends on having a good corporate governance system that include well defined criteria on who qualifies to be appointed a director of the company.

Too many or too little

What is the right number of directors to appoint to constitute the board of a company? The Companies Act sets a minimum of two without setting a cap. Invariably, this has resulted in majority of companies, especially small and medium size companies, having a two-man board of directors. This in practice becomes a one-man board especially for related parties (spouses, siblings, friends and similar appointment based on close relations). What must inform the number of directors to appoint to constitute the board? Again, there is no one-size fits all answer to this. The yardstick should be what expertise is required to effectively and efficiently direct the business of the company. That in itself may also be dependent on the sector in which the company is in and the level of operations of the company. That is, whether it is a small, medium or large size company, or a regional or multinational company. The Bank of Ghana, in its Corporate Governance Directive, has increased the minimum number of directors for companies operating in specialised deposit taking business to five and has made some prohibition in relation to related parties on board.

There must be a clear determination on the number of directors required to successfully steer the affairs of the company. As indicated above, the generally accepted corporate governance position requires on the board of a company expertise in the industry in which the company operates, expertise in finance and expertise in applicable law. This does not necessarily mean a company must have three directors. One director may have all the required expertise. A company may depend on advisors for these expertise. In addition to this, there are now requirements of diversity including ethnicity, gender and religion as well as representation of particular stakeholder. The takeaway here is, some thought must be given to the number of directors and this must be stated in the constitution of the company.

Selection or appointment of directors

Appointment of directors to some state-owned companies and statutory corporations has raised eyebrows in this country. Questions have been asked including whether the person would have submitted his or her application if the position was advertised. Directors are not employees of a company, so, advertising for such positions is generally not the norm in any jurisdiction. Notwithstanding the fact that it is generally an unadvertised position, there must be clear selection processes based on assessment of the qualification and suitability of each candidate. Once there are positive qualification criteria, there must be a process of identifying qualified persons and selecting a suitable person among the qualified persons.

Most directors of companies in Ghana are generally appointed based on personal relationships. Whilst this is not inherently bad, the lack of a formal assessment process takes away from the seriousness the appointor and appointed person must attach to the position. In some instances, there is even no properly drafted letter of appointment which gives details on requirements and expectations from the appointed director. Another process divorced of personal relationship is the use of recruitment agencies or a selection committee set up by the appointing authority (mostly shareholders) that headhunt for qualified and suitable persons to be appointed a director of a company. The positives of this option include the fact that there are discussions on requirements with the recruiter and clearly set out qualification criteria. In addition, the recruiter will conduct interviews and other assessment to determine suitability for the role.

The takeaway here is that there must be a process that is followed in the recruitment and appointment of the director. Ideally, this must be set out in the constitution of the company. If not, it can be set out in a corporate governance code or manual of the company. A lack of it leads to haphazard decision making by an appointing authority (shareholder or any person given that power) based on unknown factors.

Conclusion

A board of directors is a pivotal, if not the most important, organ in corporate governance. They are the directing mind and brain of the company. It cannot be acceptable that recruitment of employees is done through a more formal process, based on organisational needs, and clearly defined qualification requirements and selection processes than those charged with the responsibility of directing the overall business of the company. A good corporate governance system must not allow this to be the case. At the time of incorporation, do not just adopt the template or default constitution. Expressly make provisions for the above matters. If you are an existing company, it is about time you consider this and make the necessary changes to your constitution or develop a corporate governance code.