The government continues to be the biggest spender in terms of procurement of goods, works, and services. The government also remains the main provider of infrastructure and related services including roads, health facilities, sewerage and sanitation infrastructure and services, sports facilities, and residential and commercial facilities among others. All these are funded from public funds which are mostly revenue generated from taxation and national resources. The general inadequacy of public funds to finance the needed public infrastructure and services through public procurement requires an alternative approach to financing the delivery of public infrastructure and services. Public Private Partnership (PPP) arrangements provide the alternative and offer great business opportunities to private sector businesses.

In light of this, the passage of the Public Private Partnership Act, 2020 (Act 1039) (PPP Act) and providing the legal framework for PPPs must not only be welcomed but also be of great interest to private businesses. The PPP Act replaces the National Policy on Public-Private Partnerships, which was adopted in 2011.

What is PPP?

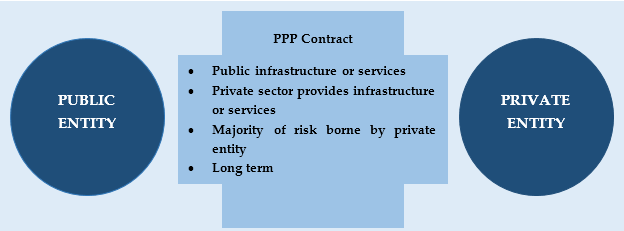

Public Private Partnership (PPP) refers to the broad range of contractual arrangements by which public sector entities pursue economic or commercial activities by partnering with private sector entities usually over a long term. The PPP Act defines PPP as “a form of contractual arrangement or concession between a contracting authority and a private party for the provision of public infrastructure or public services traditionally provided by the public sector, as a result of which the private party performs part or all of the infrastructure or service delivery functions of Government, and assumes the defined risks over a significant period of time;”

The figure below summarises the features of a PPP.

Figure 1: Features of a PPP

For an arrangement to qualify as a PPP arrangement or a project to qualify as a PPP project, the following elements must be present:

- (a) One of the parties must be a public entity or an entity owned by government.

- (b) The public entity must seek to partner with a private entity under a contract.

- (c) The private entity must be responsible for providing infrastructure and related services which ordinarily are provided by a public entity.

- (d) The private party must bear a substantial part of the risks associated with the project.

- (e) The main obligations including design, financing, construction, operation and maintenance of the project is performed by the private party.

- (f) The contract is generally for a long term.

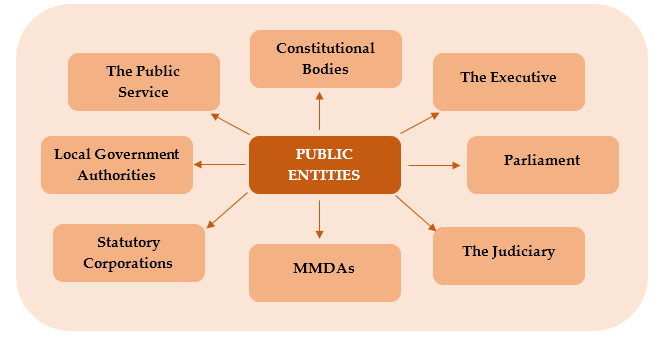

- (g) The following entities are listed under the PPP Act as public entities for which a contractual arrangement with a private sector party that satisfies the above requirement will qualify as PPP:

- (a) The outsourcing of government services without the transfer of financial and operational risks to a private party;

- (b) The grant of a mineral right under the Minerals and Mining Act, 2006 (Act 703) or any other applicable enactment on mining;

- (c) The grant of any right for exploration, development or production under the Petroleum (Exploration and Production) Act, 2016 (Act 919) and any other relevant enactment;

- (d) The divestment of ownership or equity of a state-owned enterprise;

- (e) The procurement of goods, works, and services primarily with the use of public funds by any contracting authority under the Public Procurement Act, 2003 (Act 663); and

- (f) Non-commercial activities that are the exclusive preserve of the security services.

Implementation Process

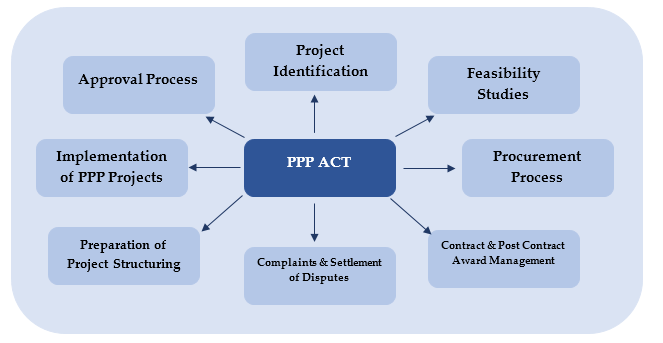

The PPP Act provides that unless a PPP Contract was executed before December 29, 2020, all PPP projects, including the process of contracting, must be in accordance with the Act. The PPP Act regulates the PPP process from start to finish that is: from project identification to procurement of private partners by the public entity to contracting to project implementation.

All aspects of PPP Projects are regulated by the PPP Act as shown below:

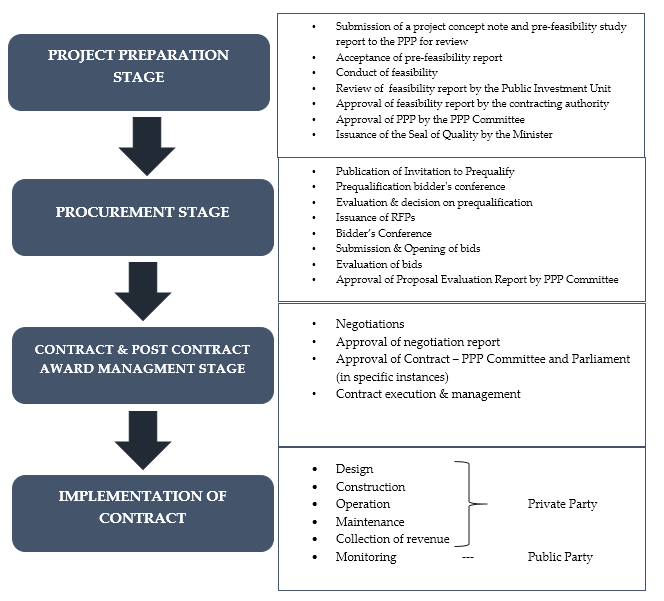

The Act sets out the requirements (including approval requirements) for each stage of the implementation process as summarised in the figure below:

- Project Preparation Stage: PPP Projects by nature are generally complex, which is typical of large infrastructure projects. A critical stage is therefore the preparatory stage which entails scoping and describing the project and conducting studies to determine the technical, legal, financial, and commercial feasibility of the project. In view of the conflicting interests of the government entity and private party, there must be a proper framework at the preparatory stage to ensure compliance with the legal requirements, optimum risk allocation and value for money. While the government entity seeks to ensure there is value to the public, the private party seeks to maximize profit. These two interests must be properly synchronized at each stage of the process. As such, the PPP Act requires various steps to be taken at each phase of the preparation stage. This must be followed in sequence with approval granted on completion of the phase.

The PPP Act requires that upon completion of the preparatory stage, the Finance Minister must issue a Seal of Quality prior to the government entity proceeding to the next phase which is the procurement stage.

- Procurement Stage: the next stage upon completion of the preparatory stage is the preparation of relevant procurement documents and launching the procurement process to engage the private partner. A two-step procurement process is recommended under the PPP Act – the pre-qualification stage and the actual proposal stage. At the qualification stage, the government institution will publish invitations for applications to prequalify indicating the minimum qualifications required to shortlist private entities to subsequently submit proposals. If the PPP is to be partly funded by the government entity, the government entity must also obtain written confirmation from the Finance Minister of the availability of funds for the implementation of the project. Upon shortlisting qualified entities, a request for proposal is issued to the shortlisted entities who then are to submit a proposal- both technical and financial- for evaluation. On receipt of proposals, an evaluation committee is set up which evaluates the proposal. The report of the evaluation committee must be approved prior to giving notice of intention to award to the winning bidder

- Contracting Stage: upon approval of the evaluation report, a negotiation committee is set up by the governmental entity to negotiate with the selected bidder on the technical and financial terms of the project agreement (that is the PPP Contract). A negotiation report is prepared by the negotiating committee and submitted to the Finance Minister and the oversight Ministry to enter into the PPP arrangement. Upon accepting the terms, the contract must be submitted for approval by the PPP Approval Committee. Where the conditions in the 1992 Constitution are triggered, the contract must be submitted to Cabinet for approval after which it must be laid before Parliament for parliamentary approval.

The government entity can only execute the contract upon obtaining all required approvals.

- Implementation of Contract: this stage comprises all the post-execution activities undertaken by the parties to the PPP contract including:

- (i) achieving financial close,

- (ii) design of the project,

- (iii) undertaking the construction, testing, and completion,

- (iv) operation and maintenance and

- (v) collection of user charges.

These obligations are generally undertaken by the private party. The government contracting entities also perform obligations imposed under the PPP Contract. This may include providing a guarantee to secure funding, acquisition of the required land, grant of permits, or assisting the private party to obtain permits and others. The contracting entity must also monitor the performance of the obligations of the private entity.

The process provided under the PPP Act may be seen as complex and complicated. This may be due to the very complicated and complex nature of major infrastructure projects. This is in addition to the competing public and private interests involved. It is therefore important that both the public and private entities engage advisors to advise on the project structure, undertake the relevant studies, and provide technical, financial, and legal advice on the contractual and procurement arrangements to ensure compliance with multiple laws and international standards. The engagement of a Transaction Advisor is therefore of utmost importance for a successful PPP process.

Business Opportunities

The opportunities offered by a PPP project are numerous. These cover business opportunities to investors, project sponsors, financial institutions, construction companies, consulting companies, suppliers, employment opportunities, and the general rippling economic effects. All these players must therefore be interested in the implementation of the new PPP arrangement.

The government had earmarked a number of projects including projects in the roads, rail, health, social, and ports sectors for implementation as PPP projects.

Conclusion

The global effect of the pandemic has put more constraints on available resources for the provision of infrastructure and related services by governments, particularly in developing countries like Ghana. The infrastructure gaps keep widening and the alternative solution to close the gap may be through the use of PPP arrangements.

Whilst government embraces this arrangement, the private sector, touted as the engine of growth must proactively prepare to take advantage of the opportunities offered by PPP arrangements.